Private equity is popular among business owners looking to grow, expand or make an exit.

When Blue.cloud’s owners recently sold a majority stake in their cloud-only digital transformation business to a private equity firm, they considered it a critical chapter in the company’s growth story.

Blue.cloud* was founded in 2021, when the owners rebranded its 15-year-old predecessor, Bluenet. As the pandemic raged, accelerating the world’s move to the cloud, the new name reflected an exclusive focus on cloud-based technologies and solutions. Securing a private equity investment from Hudson Hill Capital—known for putting money into rapidly growing mid-market tech firms—was the next strategic step.

“We saw an opportunity to work with the right partner to accelerate the growth of the company,” says Chief Financial Officer Brian Alvarez, who started with Tampa, Fla.-based Blue.cloud last year. “We believe this is going to make us much more successful going forward.”

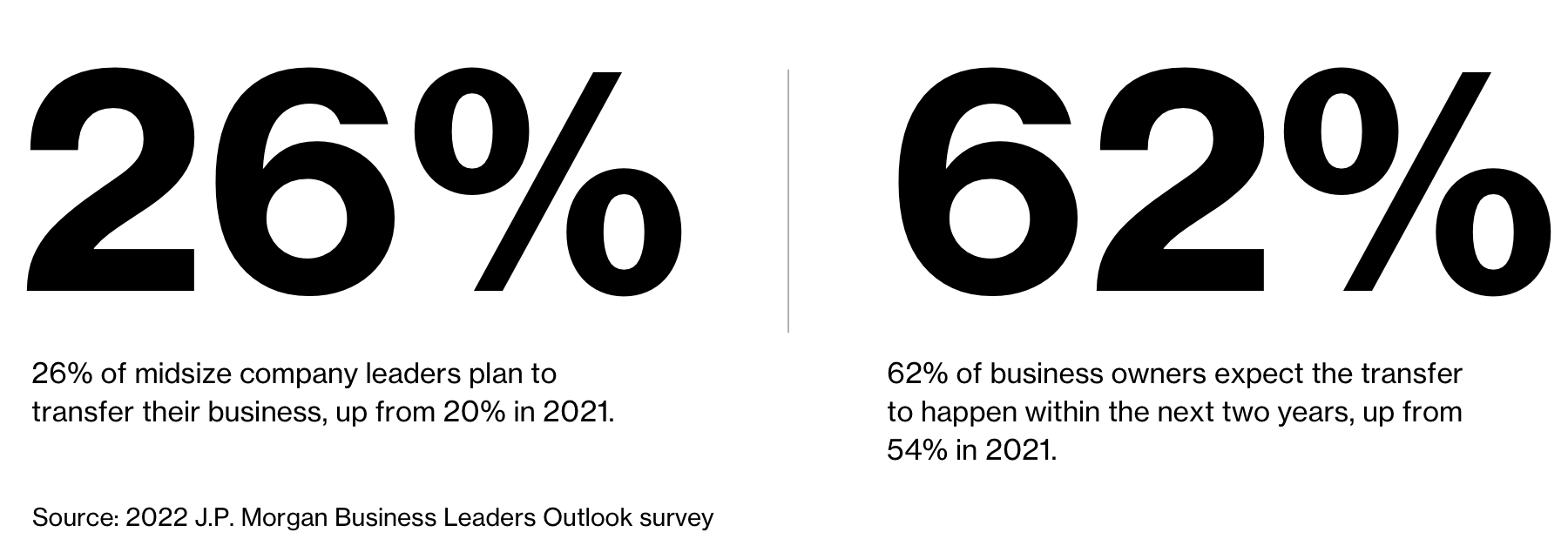

Blue.cloud’s founders are among the thousands of business owners who sold controlling or minority stakes of their businesses to private equity firms during the pandemic. U.S. private equity firms had a banner year in 2021, striking deals valued at $1.2 trillion, breaking 2019’s record by 64%, according to Pitchbook data. The number of transactions—8,600 deals—also topped the all-time high set in 2019 by 50%, after a bit of a slowdown in 2020 due in large part to a global economic shutdown, freezing credit markets and pandemic-related uncertainty in financial markets. This boom in private equity deals ran across almost all sizes, sectors and deal types, despite the extended pandemic that brought worrisome Covid-19 variants, runaway inflation and regulatory challenges, among other headwinds.

What’s behind all the deal making?

Private equity firms provide financial backing and make equity investments in companies through a variety of investment strategies, including majority-control buyouts, structured equity and minority growth equity. Of course, investors have been acquiring businesses and making investments in companies since the dawn of the Industrial Revolution, but a congruence of factors have fueled recent interest on both sides of the dealmaking table.

“It’s like this perfect storm that’s feeding into both the demand and the supply sides,” says Steve Faulkner, Head of Private Business Advisory, within J.P. Morgan’s Private Bank. “That’s what conspired to make last year a record year, and I think this year will also be a really good year, even though we’re on the back end of a pandemic.”

A combination of cheap debt because of low interest rates, a flood of good business candidates and lots of unspent capital fueled private equity’s appetite. Meanwhile, challenging market conditions brought on by the pandemic coupled with favorable valuations are driving demand among midsize-business owners.

There’s also a bigger, longer-term trend at play: Baby boomers, defined as people born between the years 1946 and 1964, account for an estimated 2.3 million—about 40%—of small-business owners in the United States, but they’re retiring in record numbers. And industry forecasts estimate that as many as 70%–80% have no succession plan in place.

Additionally, perceptions of private equity are shifting among many baby boomers and others who have associated it with the big, hostile takeovers that made headlines 40 years ago.

“Private equity of the ’80s is not the private equity of today,” says David Barbee, J.P. Morgan’s Head of Business Development, Middle Market Financial Sponsors Group. “Today, there are a lot of middle market-focused private equity funds that take a very partner-oriented approach to get businesses to the next level.”

The “10,000 flavors of private equity”

Besides business owners looking to retire, there are other good candidates for a private equity deal—for instance, someone who’s bullish on their business and wants to take some money off the table or buy out current investors. Private equity firms can also help enterprises grow and provide fresh capital and industry expertise to help them weather difficult or uncertain times.

Still, private equity isn’t for every business. For example, a founder whose goal is to build a long-term independent business would want to think twice because most significant investments lead to an eventual sale or IPO. “When we’re talking to business owners, there’s a lot of education that needs to be done about private equity because there’s capital everywhere,” says Andrew Oshman, J.P. Morgan’s Executive Director, Private Business Advisory. “There are a lot of reasons why private equity may not be a good fit.”

There are also several implications beyond valuation to consider in a private equity deal. These include what the owner’s influence will be on the business after the deal is done; corporate governance; and structural and operational factors.

There are various shades of private equity in the market, from the size of businesses these firms invest in (small-cap, mid-cap, large), to investment strategies (among them, structured equity, growth equity and buyouts) and industry specialization (technology and health care, for instance), among others. “There are 10,000 flavors of private equity, so it’s really important that business owners understand their motivations and work hard to align their interests, and the interests of their employees, their customers and the community in which they operate and serve, with those of the private equity investor,” Faulkner says.

Today’s business owners have more strategic options outside of private equity than ever before. Choosing the right advisors to navigate the landscape is key, says Faulkner, who adds that it’s critical for business owners to get comfortable with uncertainty and risk. “It’s important to understand the goals and objectives of that founder-owner at a high level while thinking about the various paths—private equity potentially being one of them,” he says.

Blue.cloud co-founder and co-CEO Kerem Koca agrees. Borrowing from his personal experience, he says owners need to do a thorough assessment of their goals and find a partner with a similar vision. “Like anything in life, you need to know what is important to you, and then make sure you go after that,” he says. “That’s exactly what we did.”